Get This Report about Financial Education

Wiki Article

Financial Education Things To Know Before You Get This

Table of ContentsThe Main Principles Of Financial Education Financial Education Fundamentals ExplainedWhat Does Financial Education Do?The Ultimate Guide To Financial EducationHow Financial Education can Save You Time, Stress, and Money.The Single Strategy To Use For Financial EducationIndicators on Financial Education You Should Know

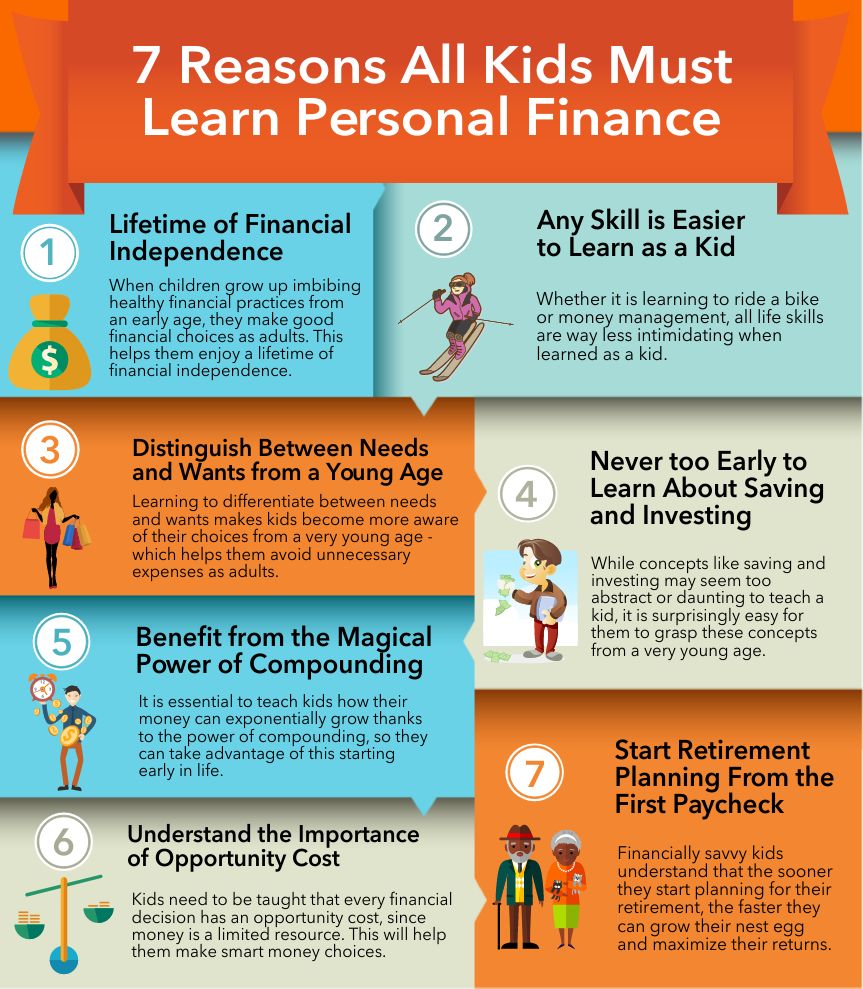

This is their intro to the monetary realm. The majority of believe that a person's economic trip begins when they start with the adult years, but it starts in childhood. Children these days have simple accessibility to practically any resources, whether it is money or some asset that money can purchase. This did not exist in the older generation, where even when sources were available, they did not have actually things handed to them.Asking your parents for pricey gifts like an i, Phone, Mac, Book, or Apple Watch, and afterwards throwing outbursts over it shows exactly how you are not ready for the globe around. Your parents will certainly try to discuss this to you, but children, specifically young adults, hardly ever comprehend this. If not instructed the importance of assuming seriously before spending, there will come a time when the following gen will certainly encounter issues, and not discover just how to take care of financial resources as an adult.

Early learning of concepts like the worth of worsening, the distinction between wants and needs, postponed gratification, opportunity price and also most notably obligation will certainly hold the following generation in excellent stead. Best Nursing Paper Writing Service. Worths of assets and also cash can not be instructed overnight, for that reason starting young is important. Simply put, whether you like it or not, monetary monitoring gradually comes to be an indispensable part of life, and also the quicker one begins instilling the habit; the earlier they will certainly grasp it, and also the better prepared they will be.

Get This Report about Financial Education

If, nevertheless, it is made compulsory in schools or instructed by moms and dads at residence, the benefits would be extensive: 1. Capability to make far better economic decisions 2.

Everything about Financial Education

Moms and dads constantly think of ensuring to maintain enough money for their children, nevertheless, they fail to recognize that a person more action has to be added in their future preparation for their youngsters. They must inculcate the basics of finance in children before they head out into the world independently because doing so will make them more liable and make their life even more hassle-free! Sights expressed over are the author's own.And also you frequently take note of your overall profile earnings, financial savings and financial investments. You also comprehend what you don't understand, and you request help when you require it. To be financially literate methods having the capability to not allow cash or the absence of it get in the method of your happiness as you function hard and also develop an American desire complete with a long as well as meeting retirement.

Personal finance professionals advise taking the time to discover the essentials, from how to manage a checking or debit account to just how to pay your bills on time and develop from there. Handling your cash needs constant interest to your spending and to your accounts and not living past your monetary means.

Financial Education Fundamentals Explained

You will certainly lose out on interest generated by an interest-bearing account. With cash in an account, you can start spending. This is where you require discretion. Find out to distinguish in between requirements and deluxes. You need to pay for Clicking Here your yearly oral cleansing, however you want to afford the beauty parlor appointment.You require to see specifically how you're spending your cash as well as determine where your financial openings are. 1. Start tracking your month-to-month costs In a notebook or a mobile application, write in every time you invest cash. Be attentive regarding this, because it's simple to forget. This is the structure for your budget.

And look at the categories. 4. Research study your variable expenses This is where many people often tend to overspend. Choose what provides you the most satisfaction from these monthly expenditures that you feel these expenses are rewarding? As well as which ones can you actually do without? Be truthful, as well as start cutting. This is the start of the difficult choices.

How Financial Education can Save You Time, Stress, and Money.

Consider cost savings An essential part of budgeting is that you ought to constantly pay yourself first. That is, you should take a portion of every paycheck and placed it right into financial savings. This one technique, if you can make it a behavior, will certainly pay returns (actually oftentimes) throughout your life.Now set your budget plan Beginning making the needed cuts in your other repaired as well as variable expenses. Determine what you want to conserve each week or every 2 weeks. The remaining cash is how much you need to reside on. Reliable budgeting needs that you are sincere with yourself as well as created a strategy that you can really adhere to.

Debit cards have benefits like no limitation on the quantity of transactions and also rewards based upon regular use. You have the ability to invest without lugging cash money and the cash is instantly taken out from your account. Because utilizing the card is so very easy, it is vital that you do not spend too much and also shed track of just how usually you're spending with this account.

The smart Trick of Financial Education That Nobody is Talking About

Some resorts, automobile rental companies and also various other businesses require that you utilize a bank card. Getting an account developed for occasional usage can be a smart decision. You can develop your credit report and take advantage of the time buffer between buying and also paying your expense. One more advantage of utilizing credit rating is the included protections offered by the provider.Relying upon a bank card can cause handling significant financial obligation. Need to you select to own a bank card, the finest technique of action is paying completely each month. It is likely you will currently be paying rate of interest on your purchases as well as the more time you carry over an equilibrium from month to month, the even more interest you will pay.

The report likewise said the typical customer has a charge card balance of $5,897. Overall Debt for American Consumers = $11. 74 trillion Financial expert Chip Stapleton provides a wise technique to get and avoid of financial obligation that anybody can exercise. A credit report can be a strong indication of your monetary wellness.

A Biased View of Financial Education

You can acquire a copy of your credit rating report absolutely free as soon as annually from each check these guys out of the credit rating bureaus. Building a high credit report can assist you get authorization for low-interest finances, credit score cards, home loans, as well as car repayments. When you are looking to move into a home or obtain a brand-new job, your credit report may be a deciding factor.Report this wiki page